Treasurer's Office

The Treasurer's Office collects current real, personal and motor vehicle taxes and oversees their disbursement to the County government, Municipalities, Public Schools and special taxing districts of Oconee County. The Treasurer's office also maintains records of revenues collected by these entities for financial reporting to various County and State offices.

Credit & debit card processing fee is 2.35% of the amount due in office and online.

E-check processing fee is $2.00

Cards Accepted: Discover, Mastercard & Visa

The DMV will mail vehicle, RV, utility trailer, and motorcycle decal(s) and registration(s) within 5 - 10 business days from the date the payment is received.

The DNR will mail watercraft decal(s) and registration(s) within 5 - 10 business days from the date the payment is received.

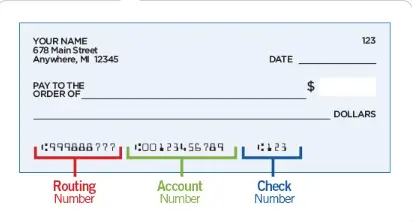

A $30 service fee will be assessed on all returned checks including “unable to locate the bank account specified”.

Make sure to enter the check information as illustrated below:

Forms of Payment Accepted:

Cash, Check (payable to "Oconee County Treasurer"), Money Order, & Debit/Credit Cards

Online & Phone payments are also accepted

Pay By Phone: 864-778-3997 (Automated)

Pay Online: Pay Online

Mission Statement:

As the custodian of County funds, the Treasurer is responsible for accurately, efficiently, and effectively collecting and disbursing all County revenue. This department strives to and is committed to fulfilling its duties and responsibilities with an emphasis on technology and a focus on unsurpassed customer service.

Online Tax Payments:

If you are experiencing difficulty paying please call 385-218-0343 8:00 AM - 8:00 PM.